BTC Price Prediction: Bullish Momentum Amid Institutional Shifts and Technical Strength

#BTC

- Technical Strength: BTC trades above key moving averages with bullish MACD momentum.

- Institutional Tailwinds: Major banks and whales are betting big on Bitcoin's growth.

- Innovation-Driven Demand: Layer-2 solutions like IBVM expand use cases amid volatility risks.

BTC Price Prediction

BTC Technical Analysis: Key Indicators to Watch

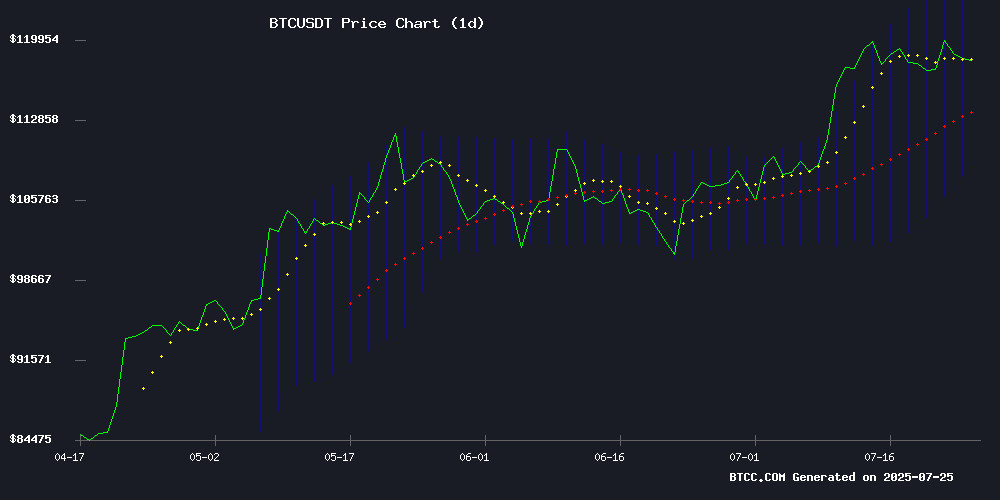

According to BTCC financial analyst Olivia, Bitcoin (BTC) is currently trading at 116,527.23 USDT, slightly above its 20-day moving average (MA) of 116,353.21. The MACD indicator shows a bullish crossover with the histogram at 1,033.73, suggesting potential upward momentum. Bollinger Bands indicate a neutral to slightly bullish trend, with the price hovering near the middle band. Olivia notes that a sustained break above the upper band at 123,628.93 could signal further gains, while a drop below the lower band at 109,077.49 may indicate a bearish reversal.

Market Sentiment: Institutional Adoption and Whale Activity Drive BTC Optimism

BTCC financial analyst Olivia highlights several bullish signals from recent news. Institutional players like Empery Digital are doubling down on bitcoin near all-time highs, while Citi has raised its year-end target to $135K. Whale activity is also picking up, with dormant addresses moving $9.3 billion in BTC and a $23.7 million bet on Bitcoin reaching $200K by 2025. Olivia cautions that quantum computing risks and fading four-year cycle theories could introduce volatility, but overall sentiment remains positive due to growing adoption and Layer-2 innovations like IBVM's upcoming token launch.

Factors Influencing BTC’s Price

Empery Digital Doubles Down on Bitcoin Near All-Time Highs

Empery Digital, formerly Volcon Inc., has made a bold $375 million Bitcoin bet, acquiring 3,183 BTC at an average price of $117,697—just shy of historic highs. The firm isn't hedging. Instead, it's tightening its equity structure and selling put options to amplify exposure, signaling unshakable conviction in Bitcoin's long-term value.

The strategy includes writing puts at $115K, $116K, and $117K strike prices, effectively positioning to accumulate more BTC below market rates while earning premiums. Simultaneously, Empery authorized a $100 million share buyback over two years, aiming to boost Bitcoin-per-share metrics and reinforce NAV.

This aggressive pivot from electric vehicles to a Bitcoin-centric treasury model marks a watershed for public companies. But with thin margins for error and fierce competition from early adopters, Empery's all-in gamble will test whether late entrants can still ride Bitcoin's volatility to outsized gains.

67% of Young Crypto Traders Trust AI to Tame Market Volatility

Young crypto traders are increasingly turning to artificial intelligence to navigate the notoriously volatile cryptocurrency markets. A recent study by MEXC Research reveals that 67% of traders aged 18 to 27 rely on AI-driven tools, particularly automated bots and adaptive strategies, to manage risk and reduce emotional decision-making.

Generation Z's approach marks a paradigm shift in trading psychology. Rather than reacting impulsively to market swings, these traders deploy bots during periods of high volatility to prevent panic selling and mental fatigue. The strategy goes beyond mere automation—it serves as a psychological safeguard against the emotional storms that often accompany crypto trading.

Bitcoin remains a primary focus for AI-assisted trading among this demographic. The trend underscores a broader movement toward emotional automation in crypto markets, where technology acts as both a risk management tool and a behavioral regulator.

Quantum Computing Threatens 32.7% of Bitcoin Holdings, ChainCode Report Reveals

The specter of quantum computing has shifted from theoretical debate to imminent reality, with ChainCode Labs quantifying the vulnerability of Bitcoin holdings. Approximately 6.36 million BTC—32.7% of circulating supply—are exposed due to cryptographic weaknesses. Address reuse accounts for 4.49 million BTC across 103 million UTXOs, creating low-hanging fruit for quantum decryption.

Google and Microsoft's quantum advancements have accelerated industry contingency planning. Multiple Bitcoin Improvement Proposals (BIPs) now address post-quantum cryptography, including BIP-360's proposed solutions. The findings, presented at the Quantum Bitcoin Summit, underscore the urgency of protocol upgrades as quantum processors near viability.

Bitcoin's public-key infrastructure remains particularly susceptible. Wallet addresses derived from exposed public keys could be reverse-engineered to private keys by quantum algorithms. The report highlights how early Bitcoin transactions—often reusing non-encrypted public keys—compound the risk for legacy holdings.

Bitcoin’s Four-Year Cycle Fades as Institutional Adoption Reshapes Market Dynamics

Bitcoin’s once-predictable four-year cycle is losing its dominance as the cryptocurrency market matures, according to Bitwise CIO Matt Hougan. Institutional involvement and evolving regulatory frameworks are altering the forces that historically drove Bitcoin’s price movements.

Hougan notes that Bitcoin halvings, previously a key catalyst for supply shocks and bull markets, now wield diminishing influence. Macroeconomic conditions have also shifted, with interest rates no longer exerting the same downward pressure on crypto assets.

The emergence of spot Bitcoin ETFs in 2024 marks a structural shift, with long-term capital inflows expected to persist. Traditional financial institutions, from pension funds to national platforms, are gradually integrating crypto access for clients.

Bitcoin Layer-2 Project IBVM Prepares for August 27 Token Launch with 1M+ Users

International Bitcoin Virtual Machine (IBVM), a Delaware-registered Bitcoin Layer-2 solution, is gaining significant traction ahead of its Token Generation Event (TGE) on August 27. The project has already onboarded over 1 million Telegram users through its airdrop bot and boasts more than 100,000 active wallets. Its mobile wallet application maintains a strong 4.8-star rating, reflecting early user satisfaction.

IBVM's leadership team combines blockchain expertise with traditional business acumen. Chairman Albert Dadon, a jazz musician turned blockchain evangelist, works alongside CEO John Sajadi, who brings deep operational experience. The project is currently in advanced discussions with top-tier exchanges and venture capital firms, signaling growing institutional interest.

The platform distinguishes itself through multilingual user experience features and has implemented token burns to reward early adopters. These strategic moves come as Bitcoin Layer-2 solutions continue gaining momentum in the cryptocurrency ecosystem, with IBVM positioning itself as a contender focused on real-world utility and scalability.

Bitcoin's Four-Year Cycle Theory Collapses Amid Institutional Shifts

Bitcoin's once-reliable four-year market cycle has fractured under the weight of institutional adoption. CryptoQuant CEO Ki Young Ju publicly retracted his April 2025 bull cycle prediction, acknowledging whales now sell to long-term institutional holders rather than retail traders.

The traditional model—where whales accumulated during bear markets and dumped during retail frenzies—no longer applies. Market dynamics have fundamentally shifted, with Ju noting 'old whales sell to new long-term whales' in a July 2025 X post.

Bitcoin Whales Awaken as Dormant Addresses Move $9.3 Billion in BTC

Bitcoin's market dynamics shifted this month as long-dormant whale addresses sprang to life. A single entity transferred 80,009 BTC ($9.3 billion) held since 2011 to institutional crypto firm Galaxy Digital. The movement represents one of the largest awakenings of dormant supply in Bitcoin's history.

Galaxy Digital subsequently routed over 10,000 BTC ($1.2 billion) to multiple exchanges within an eight-hour window. The market responded with a 2.5% price dip from $118,000 to $115,300 before partial recovery. Separate whale activity saw another 3,963 BTC ($462.5 million) move between unknown wallets.

Such large-scale movements often precede volatility. Historical patterns suggest dormant coins coming to market can signal both distribution by early adopters and institutional accumulation phases. The involvement of Galaxy Digital points to sophisticated capital deployment rather than retail selling pressure.

Whale Bets $23.7 Million on Bitcoin Reaching $200K by 2025

A significant whale position has emerged in the Bitcoin options market, with a $23.7 million bet targeting a $200,000 BTC price by December 2025. The trade employs a bull call spread strategy—buying $140,000 calls while selling $200,000 calls—indicating conviction in a substantial upside move despite recent volatility.

Market dynamics remain tense as Bitcoin faces critical support between $110,500-$113,500 following $130 million in liquidations below $115,000. Derivatives activity suggests institutional players anticipate a potential ETF-driven rally toward $180,000-$200,000, though the path remains contested.

Citi Raises Bitcoin's Year-End Target to $135K, Bullish Case at $199K

Citi has overhauled its Bitcoin valuation model, projecting a base-case target of $135,000 by year-end—a figure that could surge to $199,000 under optimal conditions. The bank's revised framework prioritizes three catalysts: accelerating user growth, spot ETF inflows, and macroeconomic trends.

Network expansion alone accounts for a projected $75,000 price floor. An additional $15 billion in ETF inflows—now responsible for 40% of BTC's volatility—could propel prices by another $63,000. Institutional participation through US spot ETFs is rapidly bridging crypto with traditional finance.

The analysis notes downside risks, including a $64,000 scenario should equity markets weaken. Bitcoin's technical structure remains robust, with prices holding firmly above key moving averages.

Bitcoin Price Prediction: Bullish And Bearish Scenarios Explained

Bitcoin remains in a consolidation phase, trading sideways without decisive momentum. The lack of a strong bounce from recent lows leaves traders questioning whether the market has found a bottom or faces further downside.

A critical resistance level at $120,200 stands as the litmus test for bullish conviction. Until this threshold is breached, the market shows no confirmation of trend reversal. Bitcoin's dominance hovering near 60.2% suggests potential capital rotation from altcoins back into the flagship cryptocurrency during periods of uncertainty.

The weak price structure reflects market indecision. Another local low below recent support levels could signal extended bearish pressure, while a dominance breakout might indicate strengthening Bitcoin sentiment at altcoins' expense.

The Smarter Web Company Expands Bitcoin Treasury to 1,825 BTC

The Smarter Web Company PLC has acquired an additional 225 BTC, elevating its total holdings to 1,825 BTC. The £19.6 million purchase underscores its commitment to a long-term digital asset strategy under "The 10 Year Plan." At an average price of £87,096 per BTC, the move positions the firm as the 26th-largest corporate Bitcoin holder globally.

SWC's Bitcoin treasury now exceeds £146 million in value, delivering a staggering 43,787% year-to-date yield. With £1 million in liquid reserves earmarked for future acquisitions, the company signals continued bullishness on institutional crypto adoption.

Is BTC a good investment?

Based on current technical and fundamental analysis, Bitcoin presents a compelling investment opportunity. Below is a summary of key factors:

| Factor | Details | Implication |

|---|---|---|

| Technical Indicators | Price above 20-day MA, bullish MACD crossover | Short-term upside likely |

| Institutional Demand | Citi's $135K target, whale accumulation | Strong long-term support |

| Risks | Quantum computing threats, cycle theory fade | Requires risk management |

Olivia advises diversifying into BTC while monitoring Bollinger Band breaks and institutional inflows for confirmation.